The ESB's Colombian Coal Habit

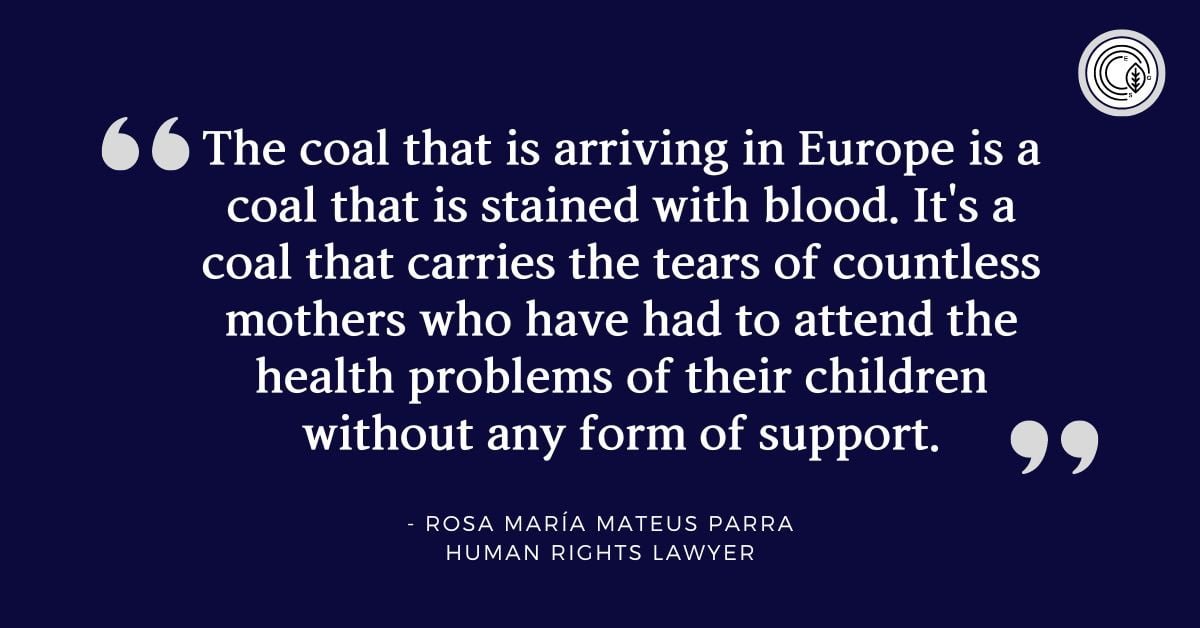

The coal is "stained with blood" declare local residents

Written by Vincent McCarthy, CFA

Featured in The ESG Factor Magazine Issue, Issue 18 l Q2 2024

Over the last two decades the Electricity Supply Board (ESB) has imported coal from the Cerrejón mine in Colombia to help power the national grid in Ireland. While the majority state-owned enterprise has made significant efforts to move to cleaner energy sources, the accumulated legacy impact of coal purchases on communities, such as in this region, must be addressed. This is an opportunity for the ESB to showcase their commitment to sustainability and the credibility of their transition plan. How they act will reflect on the people of Ireland.

Stained in Blood’

A recent RTE Prime Special brought this case to the public eye with interviews and footage from on the ground in Colombia. The mine in question is the Cerrejón coal mine in the region of La Guajira, Colombia. It is the largest coal mine in Latin America and one of the largest open-pit mines in the world. It “covers some 700 square kilometres – an area comparable to Co Louth”. Those interviewed said the people in Ireland need to know that the coal is ‘stained in blood’.

The owner of the mine is Swiss based Glencore, one of the world’s largest mining companies in the world and a company never far from controversy. Another Irish connection is that for twenty years the exclusive marketer of steam coal from the Cerrejón mining complex in Colombia was an Irish based company called Coal Marketing Company (CMC). One might ask are the taxes this company paid to the Irish government stained in blood too.

According to locals in the area, their environment has been destroyed. Their air, water and land has been contaminated. They have been deprived of their source of life. Disease, death and displacement has been inflicted on these local communities. The coal from the mine has helped power the Irish economy, but it has not lifted the indigenous people of the region out of poverty. Instead, they have suffered human rights abuse. You won’t see that story in the ESB’s sustainability report.

Human Rights Abuse

Up until 2018, over the previous two decades the bulk of the coal imported by the ESB was sourced from the Cerrejón mine. Reportedly, under international pressure this stopped in 2018, but shipments resumed in 2022 when Russia invaded Ukraine.

In 2021, the Global Legal Action Network (GLAN) (based in Ireland), in collaboration with other organisations, lodged a complaint with the OECD against a range of companies, based on “serious human rights abuses and devastating environmental pollution”. The GLAN says the ESB purchases coal from the Cerrejón mine “with full knowledge of the human rights violations and environmental harms occurring” and that this “does not align with the company’s due diligence duties”.

An initial assessment in 2022 found the complaint merited further examination. At the same time, the ESB had quietly resumed shipments of the coal, which was exposed in 2023 and later confirmed by the ESB. In September 2023, the ESB and local communities agreed to consider entering a mediation process. That does not seem to have started, but the most telling part is that there is no legal requirement on the ESB to provide meaningful redress.

ESB Response

In a response to questions from the RTE prime-time staff, the ESB issued a statement, which speaks volumes to their lack of remorse for the impact the ESB’s coal purchases have had on the indigenous communities. Some notable points include:

- “Not Anticipating”: The ESB said: “it is not anticipating any further shipments of coal from Cerrejón to Moneypoint”. That is far from saying that shipments have been permanently ended.

- “Entirely voluntary”: Regarding the mediation process, it “has signalled its willingness to engage in this process and discussions are ongoing in relation to the proposed mediation process. For clarity, participation by all parties is entirely voluntary”.

- Only 1%: The ESB states that: “Since 2018, ESB coal purchases from the Cerrejón mine have been very limited. In total since 2018, ESB’s purchase of coal sourced from the Cerrejón mine amounted to circa 1% of the total produced by the mine.”

It is a miserable response that lacks empathy. It is an abdication of responsibility and illustrates the fluidity of commitments to sustainability. The ESB are effectively saying, ‘we probably won’t ship more coal, we’ve no legal obligations to right our wrongs, and after all we only took 1% of the mine’s production since 2018. Also, we won’t mention pre 2018.’

Irish abroad

Listening to the locals interviewed, they are appealing to the people of Ireland, reminding us that while we powered our energy needs with the coal mined from their land, their people have died, and the communities continue to suffer. Given that the ESB is a majority state-owned company (97% state owned, 3% is held by the trustees of an Employee Share Ownership Plan), we do bear a responsibility.

The Irish State, of which we elect a government to represent us, earns the annual dividends, and the tax revenue. In March, ESB proposed a dividend of €220m, €213.4 million of which will be paid to the Irish government and the remainder to the Employee Share Ownership Plan. When the ESB operate abroad they are flying the flag of Ireland. How do we want to be represented?

Compensation – 1% in Reverse

When it comes to compensation, the ESB have reminded everyone their participation in the mediation process is “voluntary”. But what should redress look like?

There needs to be a comprehensive and independent assessment of the environmental damage caused by mining activities and the impact on communities, and a restoration plan put in place to deal with:

- Reclamation of mined land

- Water management

- Habitat restoration

- Air quality improvement

- Socioeconomic development

In downplaying their responsibility, the ESB said they have only imported 1% of the mine’s production since 2018. Therefore, using that logic, to get the process started, the ESB should immediately pay 1% of their 2023 corporate profits (€868 million), which equates to €8.68 million, into a community transition fund. After all, it is only a 1% impact.

That should get the feasibility studies completed, with a credible and detailed restoration plan, and the hiring of local people to get started on the most pressing issues.

Since the ESB has been importing coal for twenty years, then the 1% rule should apply to the corporate profits in each of those years. Those figures will need to be adjusted for inflation, plus a reasonable interest rate to price in the suffering caused over that period.

That is just ESB. Then you move on to every other company involved, including Glencore, who posted profits (EBITDA) of $34.1 billion and $17.1 billion in 2022 and 2023, respectively. And finally, the respective governments who have earned dividends and tax revenue should also make a meaningful contribution. That is what accountability looks like.

Green Bonds

The case also raises questions about the nature of green bonds, a debt instrument where the proceeds of the sale are used to fund projects aimed at supporting a company’s sustainability transition. The market for green bonds has grown rapidly in recent years as investor interest in sustainable investments has increased.

ESB reports that as of June 30th, 2023, 17% of their total corporate debt was made up of green bonds. The demand for green bonds allows the ESB to borrow capital for sustainability related projects from investors looking to earn a return and align with companies prioritising sustainability.

How green is a bond when the capital is still being allocated to a company that is having a material negative impact on communities? Is it reasonable to look at the financing of a project in isolation? Or should green investors take a more holistic perspective and demand the inclusion of criteria that also directly targets the dirtier side of a business?

For example, the ESB issued a 12-year green bond in September of last year with a 4.25% interest rate, with capital to be used for eligible renewable energy projects. The same year they were importing coal from Colombia, contributing to the infliction of misery on local communities. Should a green bond stipulate the requirement for the ESB to redress such issues?

These are questions for green bond investors that go beyond just ESB. It about the direction of the green bond market and the need for transparency. Another great example is Coca Cola. It can describe itself as “a leader in sustainability”, issue a green bond for “sustainability projects”, while also maintaining its position as the world’s leader in plastic pollution. That is just one area where Coca Cola has wreaked havoc on the planet, and people.

ESB – Driven to make a difference.

In their Green Bond Framework 2023 document, the ESB lay out their sense of purpose under the heading “Driven to make a difference”.

“Since its establishment in 1927, ESB has been characterised by a commitment to drive society forward and deliver a brighter future for the customers and communities we serve. This strong sense of purpose is reflected in our constant and unwavering commitment to tackling society’s biggest challenges, enhancing people’s lives and creating new opportunities for individuals and communities to thrive. We are driven to make a difference.”

Will this strong sense of purpose guide the ESB and its shareholders (the Irish State and ESB employees) to do right by the people impacted by the Cerrejón coal mine activity. Looking to the future, the ESB’s sustainability transition plan has no credibility if it does not address the dirtier side of its past.

Conclusion

The case is a reminder of the importance of activist organisations shedding light on corporate behaviour, providing a much needed voice for the exploited and forgotten.

While economic development brings many benefits and comforts for some of us, it also leaves in its wake degradation, displacement, and exploitation for others.

The people’s story of the Cerrejón mine highlights the glaring hole in the sustainability transition plans produced by governments and companies. While they project a more sustainable future, these plans fail to account for the clean-up of their contribution to the global environmental and social damage we see today, accumulated over previous decades.

End

Join our network of informed decision makers