Sustainable Investing

What does it mean to you?

by Kathy Ryan, Head of Responsible Investment, Irish Life investment Managers

Investing is, or should be, for everyone. But research suggests that financial jargon puts 70% of people off investing.[1] Industry specific language and terminology has its place, but when it comes to communicating vital investment ideas – that affect our future savings and wellbeing – it’s less helpful.

Coming to terms with the concept of sustainable investing – home to acronyms including ESG (Environmental, Social, Governance), SRI (Socially Responsible Investing), RI (Responsible Investment) and the SDGs (Sustainable Development Goals) – can often feel like wading through alphabet soup.

In this update, we explore some common terms relating to sustainable investing and show how they affect you, the end investor.

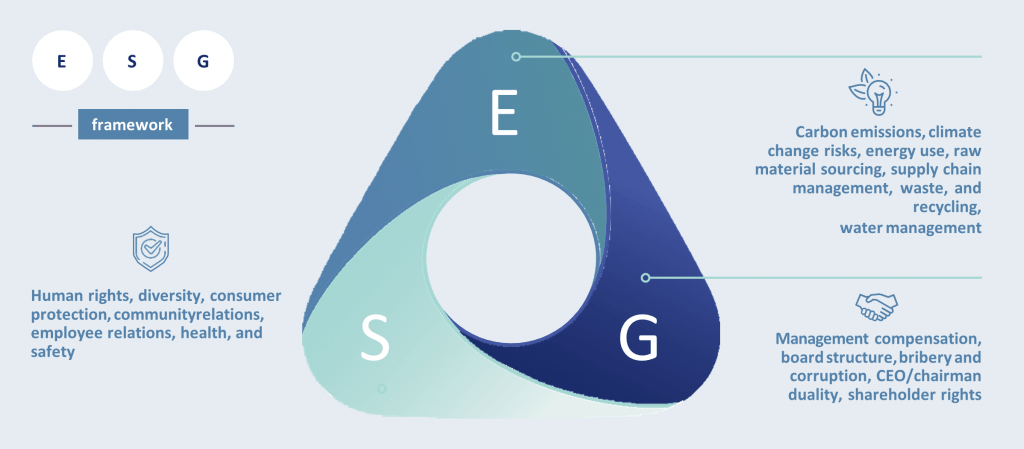

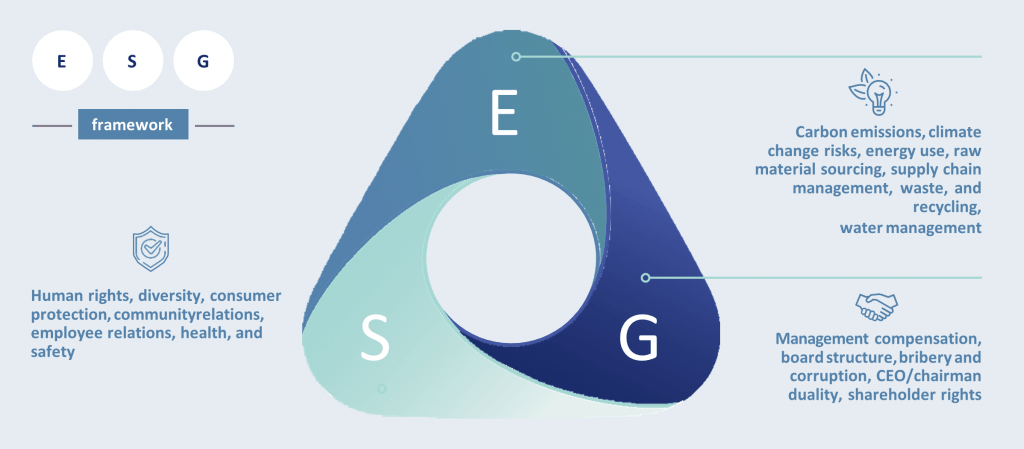

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) FACTORS

Those of us with pension plans and savings are likely to have at least some exposure to stock markets. This means our money is invested in companies that are large and profitable enough to be listed on a stock exchange. When that money is invested, the company uses it to grow the business. It might do that by developing a new product or service, or expanding into a new market.

But in recent years, as issues like climate change and human rights have become both urgent and mainstream, investors have started to question how their money is being used. Are the companies they’re invested in treating their employees well? Is slave labour used in their supply chains? Are they producing products or services that damage the natural world? Ultimately, do I want to invest in this company or not?

These are thorny questions, especially to those invested in an index of many companies (the S&P 500, for example, invests in 500 companies). To answer them, professional investors developed a framework based on environmental, social and governance factors.

This framework makes it easier to evaluate companies, and to arrive at a net ESG score. For professional investors, there is another motivation. Research shows that companies which treat their employees well show evidence of sustainable business practices, respect the living environment and have better financial outcomes. In other words, their shares fare better over the long term. By contrast, companies that score poorly against ESG metrics are more exposed to the risk of controversy affecting the share price. As well as being better for environment and society, adherence to ESG factors makes good financial sense.

SOCIALLY RESPONSIBLE INVESTING (SRI)

As we’ve outlined above, ESG factors help investors make a decision about the financial risk represented by companies. Socially Responsible Investing, meanwhile, is less about the financial risk and more centred on points of morality and ethics. Stemming from 18th century Methodism, its early adherents opposed the slave trade and would not invest in companies producing tobacco or alcohol. In the 1960s, US opponents of the Vietnam War campaigned for companies involving arms/ defence to be blacklisted from university endowment funds. [2] And in the 1980s, a successful campaign was started to divest from South Africa, due to apartheid. [3] The common strand between all of these examples is a tactic of avoidance, known today as ethical screening.

There are many takes on ethical screening, but they’re based on the same principle – excluding investment in stocks that harm humanity and the natural world. Socially responsible investments typically exclude investments in companies that produce or sell harmful products or services (like alcohol, gambling, and tobacco) in favor of seeking out companies that are engaged in social justice and sustainability.

Exclusion v Engagement

Whether investors should divest or engage has been debated for many years. Both strategies make an impact, which is why most investors have decided to employ both tactics to drive improvements in their investee companies. Engagement is often a more effective tool for investors to push companies to behave in a more responsible way, considering the wider interests of all their stakeholders. However, when engagement is ineffective over a prolonged period and the company continues to behave in an irresponsible way, then divestment should be considered. Combining both strategies is a more effective way of driving positive change in companies rather than just using either strategy in isolation

RESPONSIBLE INVESTMENT (RI)

Responsible investment is an investment philosophy that recognises the importance of considering ESG factors in making investment decisions. ESG data gives investors valuable insight into how well a business is run, what its material risks are and how sustainable its business model is. These factors are used in the risk assessment of strategies and are incorporated into both investment decisions and risk management processes. A feature of sustainable investing is an emphasis on companies that attend to their environmental challenges, treat their stakeholders well, and govern themselves well.

THE SUSTAINABLE DEVELOPMENT GOALS (SDGs)

Published by the UN in 2015, the sustainable development goals aim to direct investment capital to specific issues. The idea is to meet each goal by 2030.

Some asset managers are already ‘mapping’ their portfolios to the SDGs, to show interested investors how their capital is allocated. With less than a decade to go to meet the goals, expect to hear more about the SDGs in the years ahead.

SUSTAINABILITY

There are varying views on what the term ‘sustainability’ means. We like the definition offered by Will Oulton, the Chair of the Board of Eurosif: [4] “The name sustainability is derived from the Latin sustinere (to hold; put up with; sustain). Sustain can mean ‘maintain’, ‘support’ or ‘endure’, so we can think of this in terms of activities contributing to the health of the ecosystem, avoiding environmental degradation and resource scarcity, and promoting social equality health and cohesion. Put even more simply, ‘do no harm’. “If more users of financial products challenge their suppliers on the ‘do no harm’ question, we should see faster progress to a fairer and socially connected capital markets system, one that can benefit investors, society and the environment”.

HOW SUSTAINABLE IS MY FUND?

With all this terminology and different naming conventions, it’s no wonder that the European Union felt the need to introduce legislation to help consumers understand the breadth of investment options promoted by the pensions and investment industry. The Sustainable Finance Disclosure Regulations (SFDR) came into force on 10 March 2021. The outcome of this regulation for customers is that they will be able to compare their investment options easily and make informed decisions about how they invest their money.

Until that date, neither customers nor their advisers had any simple way to adequately compare the sustainability approaches of different funds – different managers described their funds in different ways. There was no classification system in place to identify funds that captured sustainability in their design or to spot those that didn’t. SFDR aims to address these challenges and now requires all investment products to be classified by their approach to sustainability. For those funds that do consider sustainability, there is now a prescribed way of describing both the funds and their approach.

This means that customers and their advisers can now clearly identify funds that capture sustainability issues in their design, and can easily compare these funds against alternatives. They can assess the targeted outcomes before they choose to invest in a fund. Once invested, they will receive regular updates of how that fund has performed, including in relation to its sustainability objectives.

End

E-mail Insights@ESG.ie to subscribe to The ESG Factor Magazine.

References

3 https://www.investopedia.com/articles/economics/08/protest-divestment-south-africa.asp

4 https://www.copylabgroup.com/interviews/copylab-meets-will-oulton-responsible-investing/

Disclaimer

This document is intended as a general review of investment market conditions. It does not constitute investment advice and has not been prepared based on the financial needs or objectives of any particular person, and does not take account of the specific needs or circumstances of any person. The author cannot make a personal recommendation for any person and you should seek personal investment advice as to the suitability of any investment decision or strategy to your own needs and circumstances. Any comments on specific stocks are intended as an objective, independent view in relation to that stock generally, and not in relation to its suitability to any specific person. ILIM may manage investment funds which may have holdings in stocks commented on in this document. Past performance may not be a reliable guide to future performance. Investments may go down as well as up. Funds may be affected by changes in currency exchange rates.

Irish Life Investment Managers (ILIM) is an appointed investment manager to Irish Life Assurance plc

Irish Life Investment Managers Ltd is regulated by the Central Bank of Ireland