Corporate ESG News and the Stock Market

Takaya Sekine, Deputy Head of Quantitative Research at Amundi Asset Managment, provides a brief snapshot of his team’s latest ESG research paper.

ESG data is increasingly integrated into investment processes. However, the information contained in ESG-related news for corporates has not been entirely exploited by institutional and long-only investors. The objective of our latest paper has been to identify the benefits of ESG news information for active and factor-based investors.

In our 2019 research [1], we had identified a shift from a static to a more dynamic view of ESG scores. We described active management with the Fama and French [2] sorted portfolio approach. For some pillars in the analyzed Eurozone and North America region, we had a significant out performance relative to other quintiles from the second to last quintile. This abnormal return gave way to the assumption that investors had recently benefited from ESG improvers and momentum strategies, which are by nature dynamic.

ESG News Metrics

Amundi calculates ESG Scores on a monthly frequency. For each company, the scores for ESG, the E, S and G pillars, as well as sub-pillars and additional special scores. Given our long commitment to ESG, the Amundi ESG scores have the advantage to be point-in-time since 2010 as compared to other scores, which might have been recalculated on past periods. The ESG news related metrics are sourced from Truvalue Labs, a provider of Artificial Intelligence powered ESG insights and analytics.

Benefit for Active Managers

In our research, we quantify the benefit for active managers of ESG news information. ESG news volume indicates an increased attention brought to investors, lenders, employees and all stakeholders. If the Efficient Market Hypothesis holds, differences in news volumes should not bring changes in asset returns as the hypothesis is based on all available information being integrated in the asset prices. In the case of ESG news we are in the situation where these ESG news items – which were explicitly considered extra-financial – are migrating to the mainstream of financial news. Thus, there should still be opportunities for active managers if ESG news has not become fully mainstream.

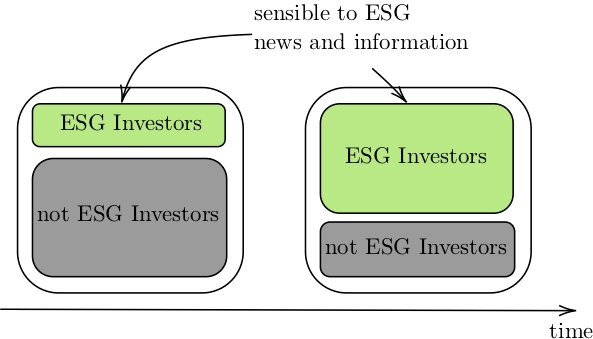

Translated to the paradigm of the Adaptive Markets Hypothesis [1], we have an ecology with two species (a.k.a market participants):

- our first species are ESG-driven investors;

- while our second species consists of investors who consider that ESG is and remains extra-financial.

In the current context of changing business conditions and the increased focus on sustainability, we can witness that the population is transitioning from the second to the first ESG-driven species.

Our Findings

For that purpose, we analyze ESG sorted portfolios in investment universes filtered with ESG news volume for which we use the Truvalue Volume information.

- We find that this universe filtering approach has been efficient in the early 2010s.

- In the 2010-2013 period, complementing ESG sorted portfolios with a filter on the number of ESG news volume was a very successful approach, mainly on the sorting in the lower “edge” (bottom 20% vs. second to last 20%) but also on the higher “edge” (best 20% vs. second to best 20%).

- Lately, it has helped to adapt to the more dynamic approaches in ESG investing.

Real World Application

In addition, we increase the “visibility” of ESG by filtering industries on their relevance to two ESG frameworks. We run a simple routine to find common keywords between SASB – Sustainable Accounting Standards Board – issues and the SDGs – Sustainable Development Goals. For investors seeking to support the realization of the SDGs, it does make sense to focus on areas with financial materiality.

While the SDGs were not designed primarily for corporates, we found that since 2012 in North America and 2013 in Eurozone, the strategy based on ESG sentiment (for which we use the Truvalue Materiality Insight Score) filtered on consistency between SASB materiality issues and SDGs has been outperforming the ESG sentiment long-short strategy.

Surprisingly, most of the value-added comes from the short-side. Interestingly, PRI had established a Hedge Funds Working Group with the aim to integrate ESG factors in the hedge fund industry. Regarding the specific practice of short selling, the Working Group considers that it is part of a well-functioning market, with no interest in a manicheistic view on the practice.

Conclusion

This is an area that we believe will continue to garner attention as ESG related news becomes more mainstream. There are significant changes ahead over the next decade as ESG gathers further momentum and informed investors can be better placed to take advantage of the opportunities.

End

This article was written by Takaya Sekine, Deputy Head of Quantitative Research at Amundi Asset Management, providing a brief snapshot of their latest ESG research paper.

To read the full working paper visit – https://research-center.amundi.com/page/Publications/Working-Paper/2020/Corporate-ESG-News-and-The-Stock-Market?search=true

To subscribe to our insights, e-mail Insights@esg.ie.

References

[1] Drei, A., Le Guenedal, T., Lepetit, F., Mortier, V., Roncalli, T., & Sekine, T. (2019). ESG Investing in Recent Years: New Insights from Old Challenges. Amundi Discussion Paper, 42.

[1] Fama, E.F., & French, K.R. (1993). Common Risk Factors in the Returns on Stocks and Bonds. Journal of Financial Economics, 33(1), pp. 3–56.

[1] Lo, A. W. (2004). The Adaptive Markets Hypothesis. Journal of Portfolio Management, 30(5), pp. 15–29.

IMPORTANT INFORMATION

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.